Buy Marijuana Online At Golden Dispensary for Dummies

Wiki Article

Buy Marijuana Online At Golden Dispensary for Beginners

Table of ContentsSome Known Factual Statements About Buy Marijuana Online At Golden Dispensary Buy Marijuana Online At Golden Dispensary - The FactsUnknown Facts About Buy Marijuana Online At Golden DispensaryThe Single Strategy To Use For Buy Marijuana Online At Golden DispensaryThe Only Guide to Buy Marijuana Online At Golden DispensaryThe Buy Marijuana Online At Golden Dispensary PDFsThe Main Principles Of Buy Marijuana Online At Golden Dispensary Buy Marijuana Online At Golden Dispensary Things To Know Before You Get This

With a couple of clicks of a button, you can have your favorite marijuana strains and also products supplied to your doorstep without the lines or traffic. For hectic customers, this is the very best choice bar none. Research: Before you shell out cash online, you can make the effort needed to do a thorough research study on the brands, item reviews, as well as much a lot more.Online, you can also compare rates with other stores while taking advantage of countless promotions as well as discounts. Safer: Purchasing marijuana online eliminates human get in touch with, which allows you to have satisfaction that you aren't endangering your safety and security as well as your health. Regardless of how you choose to purchase, each approach has its very own advantages (Buy Marijuana Online At Golden Dispensary).

After having checked out these, what technique do you still like?.

A Biased View of Buy Marijuana Online At Golden Dispensary

You'll pay an application charge and have your photo taken for your ID card. Application fees differ by area, yet they are not more than $100.

Top Guidelines Of Buy Marijuana Online At Golden Dispensary

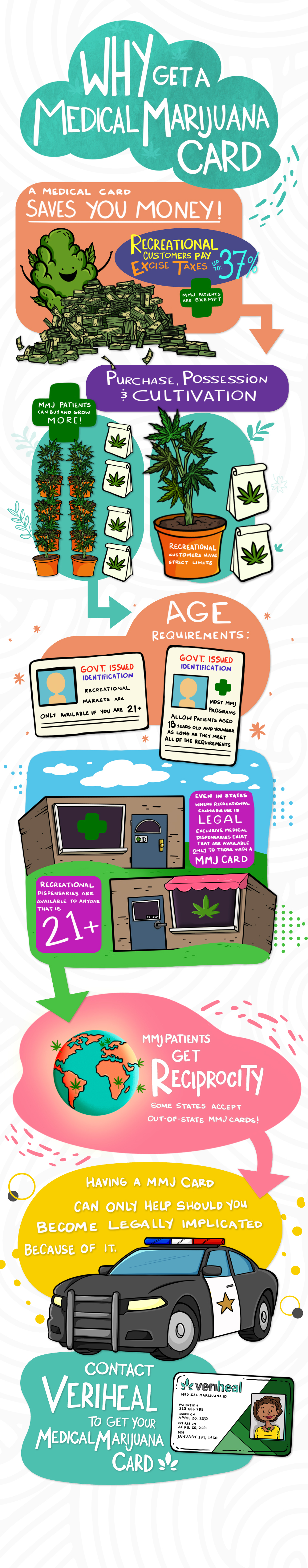

Additionally, furthermore states allow and permit As well astax obligation low rates) prices purchase of marijuana for cannabis use. Tax obligations on the purchase of marijuana for clinical use are not considered cannabis tax obligations. Where is cannabis legal and strained and just how much revenue do state as well as local governments elevate from cannabis?As a percent of total state tax collections that financial year, state marijuana tax obligation revenue ranged from 0. 3 percent in The golden state and also Maine to 1.

Although we do not have extensive information on neighborhood cannabis tax income and also earnings from general sales taxes on marijuana acquisitions, the minimal data suggest governments are accumulating considerable added revenue from these tax obligations. In Oregon, the state government levies a 17 percent cannabis tax obligation on the retail rate and also regional governments can additionally levy a 3 percent tax obligation.

The Buzz on Buy Marijuana Online At Golden Dispensary

g., medical professional visit, application fee) limitation its consumption. Because of this, states do not elevate much income from these tax obligations. What are the different sorts of marijuana taxes? There are 3 major ways state and also city governments tax obligation recreational marijuana. Percentage-of-price. A percentage-of-price marijuana tax commonly works like a basic sales tax obligation in that the tax is determined as a percentage of the list price, is paid by customers in addition to their purchase at check out, and is remitted to the federal government by the seller.

State marijuana tax obligation prices vary from 6 percent in Missouri to 37 percent in Washington. Neighborhood marijuana tax obligations are generally topped by the state as well as set between 2 percent as well as 5 percent. The percentage-of-price tax is the most prominent tax on cannabis. Ten states exclusively utilize this sort of tax obligation and also 5 states utilize it in enhancement to one more tax obligation.

Tax computations vary across these states, yet in every state the cultivator (i. e., marijuana grower) is accountable for paying the tax to the federal government, and in every state however New Jacket different parts of the plant are strained at different rates (e.

Potency-based. A potency-based tax obligation is calculated based on the cannabis item's degree of tetrahydrocannabinol (THC), the primary psychoactive compound in marijuana. Buy Marijuana Online At Golden Dispensary.

Neighborhood governments can likewise impose an excise tax obligation on cannabissome levy a percentage-of-price tax as well as others impose a weight-based tax obligation. Lawful sales began in October 2016.: The state levies a 16 percent excise tax on marijuana sales that is paid by customers and also remitted by sellers. There are no regional cannabis taxes in Arizona.

Facts About Buy Marijuana Online At Golden Dispensary Revealed

The last tax can be used on the farmer, representative, and also the seller, which means the tax obligation concern on the consumer is possibly well above the noted tax obligation rate. Legal sales began in January 2018.: The state levies both a 15 percent excise tax on cannabis sales (paid by consumers as well as remitted by stores) and a weight-based tax (paid and remitted by cultivators).

g., edibles) are exhausted at 20 percent of list price. Neighborhood federal governments can additionally impose a percentage-of-price excise tax obligation on marijuana. The neighborhood tax obligation price is covered at 3 percent for districts and also 3. 75 percent for areas. Nonetheless, the area tax visit this site right here obligation is covered at 3 percent when there is additionally a municipal tax on the acquisition.

Buy Marijuana Online At Golden Dispensary for Beginners

Legal sales started in October 2018 however the state did not start gathering cannabis tax obligation income until November 2020.: Maryland citizens approved entertainment cannabis in November click now 2022. The tally step did not contain a marijuana tax, however instead advised the legislature to create one. As of April 2023, lawful cannabis sales had actually not yet begun in Maryland.75 percent excise tax on marijuana sales that is paid by consumers and remitted by merchants. City governments are also enabled to levy up to a 3 percent tax obligation on the list price. Lawful sales started in November 2018.: The state levies a 10 percent excise tax obligation on cannabis sales that is paid by consumers and also remitted by sellers.

: The state imposes a 20 percent excise tax on cannabis sales that is paid by customers and remitted by merchants. City governments are likewise permitted to levy as much as a 3 percent tax obligation on the list price. Legal sales began in January 2022.: The state levies both a 10 percent excise tax obligation on marijuana sales (paid by consumers as well as paid by stores) and a weight-based tax (paid as well as paid by farmers).

The 7-Second Trick For Buy Marijuana Online At Golden Dispensary

There are no local cannabis tax obligations in Nevada. Lawful sales began in July 2017.: The state's weight-based tax is collected by farmers. New Jacket utilizes one tax price for all components of the plant.Report this wiki page